tax loss harvesting wash sale

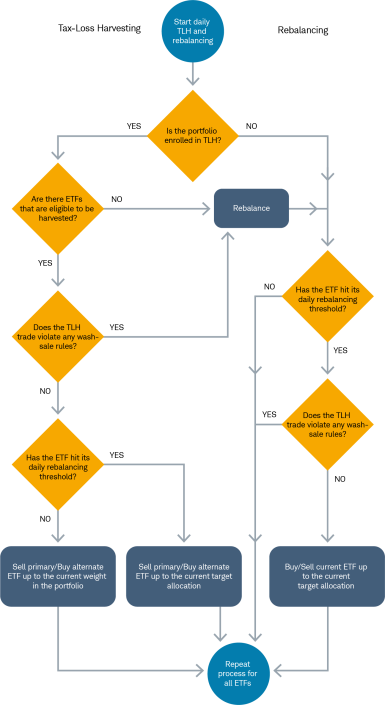

Use tax-loss harvesting to take advantage of capital losses eligible portfolios proactively sell underperforming investments and replace it with a similar position. 2022 has been a volatile year in the stock market.

Rebalancing And Tax Loss Harvesting In Schwab Intelligent Portfolios Charles Schwab

The opposite of a.

. Miller says the reinvestment part of the tax loss harvesting equation must be tackled carefully. A wash sale is one of the. But I keep a silver lining in mind.

If Eds advisor had not. Advisors who harvest tax losses must beware of the substantially identical rule that could trigger a wash sale. One of the reasons why crypto makes the perfect candidate for tax-loss harvesting is due to the wash sale rule.

That type of mismatched tax. Some traders and tax preparers import. Advisors need to be careful.

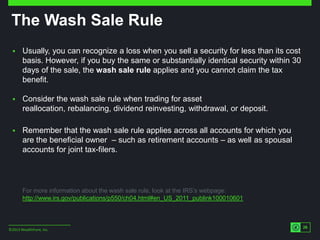

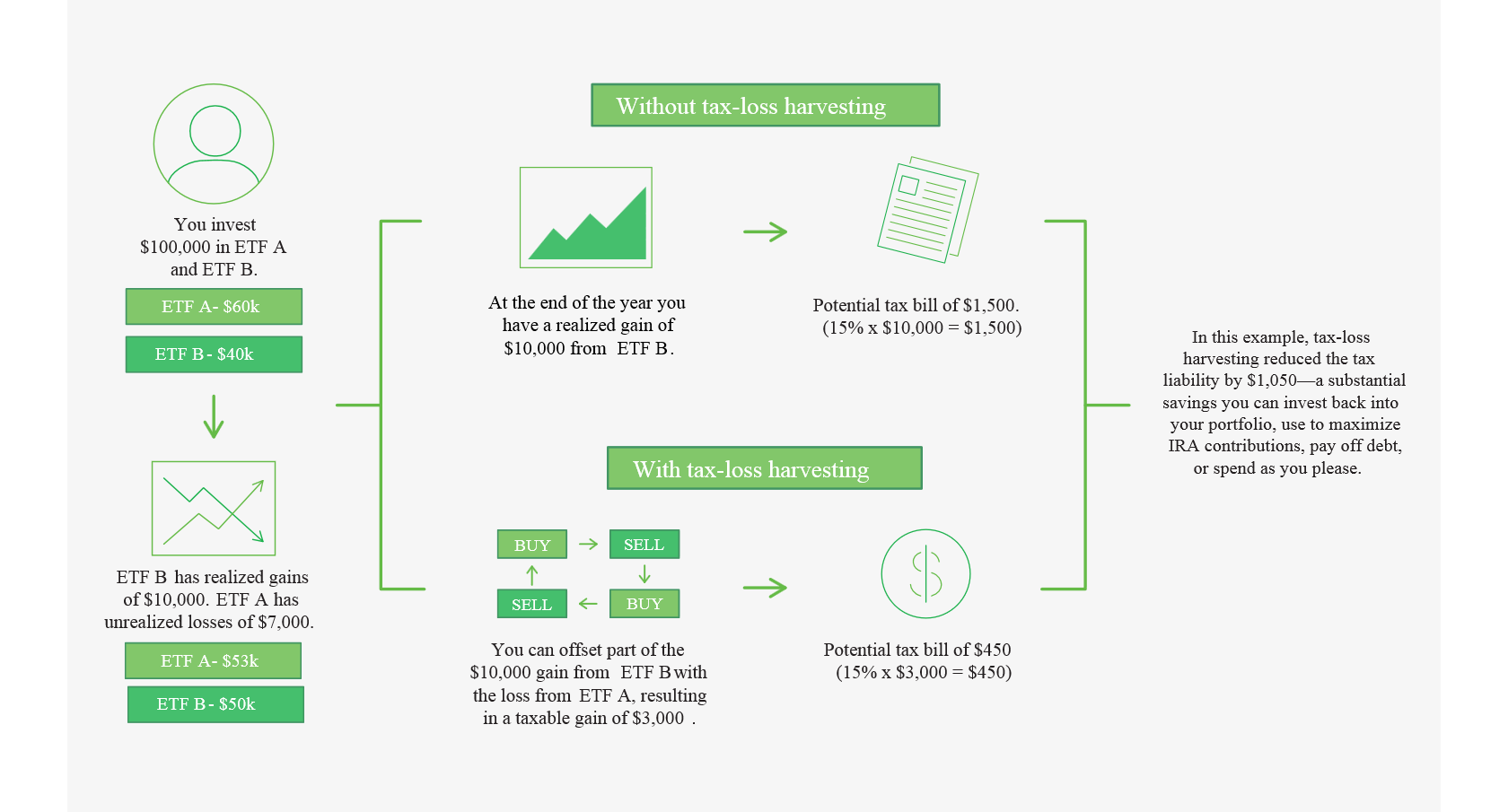

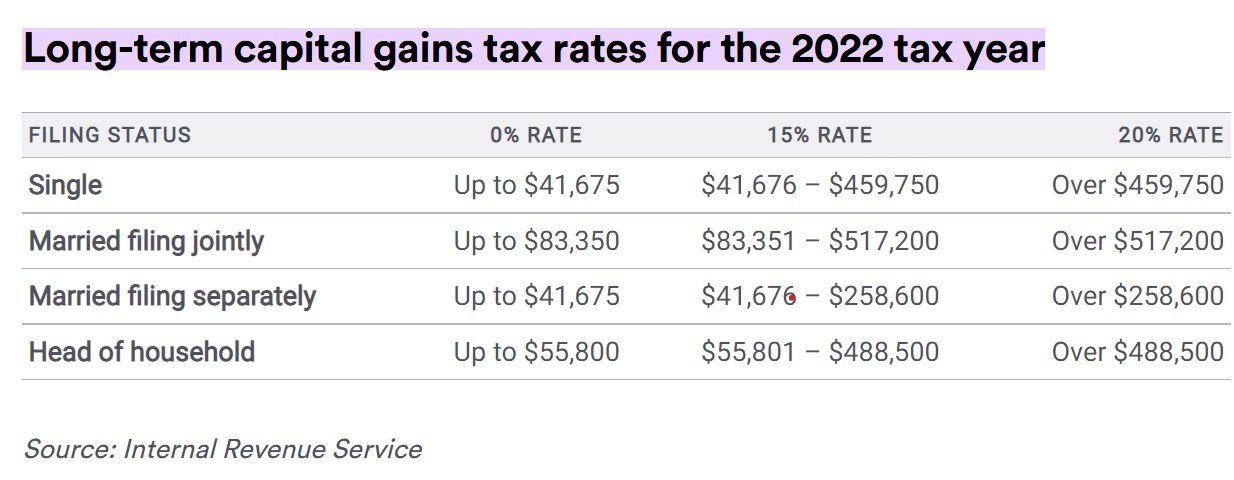

This results in a net capital gain of 50000 30000 20000 and a tax bill of 20000 15 3000 at a 15 Federal capital gains tax rate. Watch out for the wash sale rule The IRS wont allow you to sell an investment at a loss and then immediately repurchase it known as a wash sale and still claim the loss. To do it you simply need to lock in a loss by selling the.

My investment losses can potentially become tax benefits through a process called tax-loss harvesting. But if you sell SPTL at a loss and buy VGLT theres a good chance that it will trigger a wash sale and your tax loss harvest will be disallowed. Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US.

Year-end planning will undoubtedly include tax-loss harvesting to offset capital gains for many clients. The term wash sale refers to harvesting losses selling stocks or securities at. It is typically used to limit the recognition of short-term capital gains.

The rules on wash trades are vague. Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability. To claim a loss for tax purposes.

You can fully offset the tax owed on your 10000 capital gain with 10000 of your capital losses on your 2022 tax return. Thats too late to avoid WS losses. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks.

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end. Most traders dont realize they have a WS loss problem until they receive 1099-Bs in late February. Investors looking to write off any capital losses need to beware of wash sales which can derail their attempt to claim a deduction during tax time.

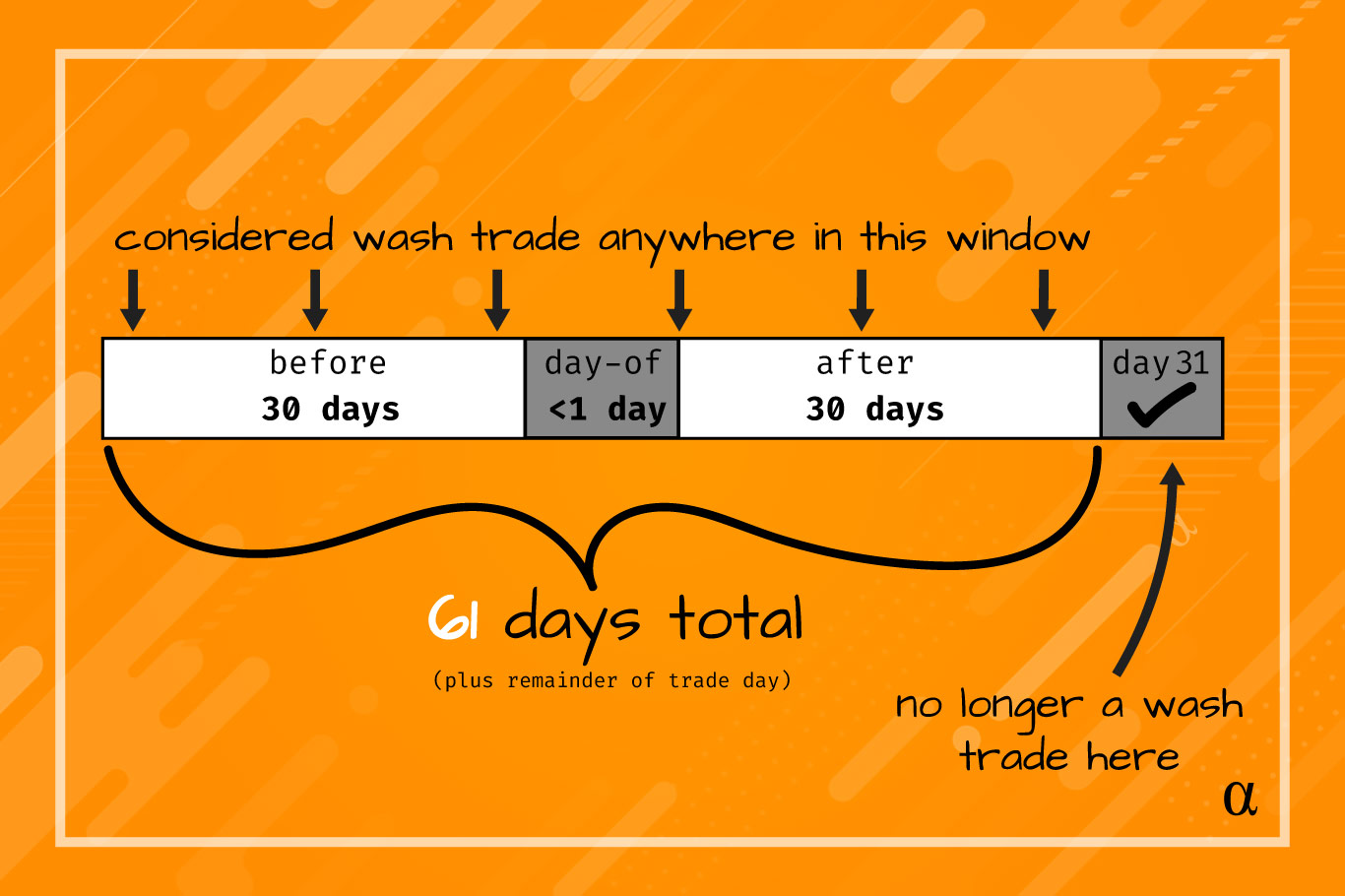

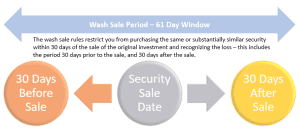

Under its wash-sale rules the IRS disallows a tax loss if the investor. While many investors tend to focus on tax-loss. The wash sale rule is avoided because December 22 is more than 30 days after November 21.

As you approach this with your. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their. In addition you also can use your losses to offset the.

But you need to familiarize yourself with the wash sale rule which. If you buy the same. You can achieve the same goal with a less expensive alternative approach.

An Investor S Guide To Wash Sale Rules Tax Loss Harvesting

Crypto Tax Loss Harvesting Investor S Guide Koinly

Decoding Tax Loss Harvesting Johnson Bixby

Irs Wash Sale Rule Guide For Active Traders

What Is Tax Loss Harvesting Smarter Investing

How To Avoid Taxes On Wash Sale Losses

In Tax Loss Harvesting Step Carefully Through The Wash Sale Minefield Thinkadvisor

New Tax Time Strategy Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

Planning To Tax Loss Harvest Beware Of The Wash Sale Tax

Wash Sale Rule Maximizing Tax Deductible Losses When Investing Alpharithms

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

5 Situations To Consider Tax Loss Harvesting Turbotax Tax Tips Videos

Year End Financial To Do Considering The Tax Loss Harvesting Strategy Benjamin F Edwards Financial Advisors November 26 2019

Watch Out For Wash Sales Charles Schwab

Tax Loss Harvesting Napkin Finance

Planning To Tax Loss Harvest Beware Of The Wash Sale Tax

The Crypto Market Is Down Time To Take Advantage Of Tax Loss Harvesting Taxbit