ny highway use tax rates

New York imposes a highway use tax NY HUT or New York Highway Use Tax on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. Enter the security code displayed above.

Ny Hut Permits Ny Hut Sticker J J Keller Permit Service

The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you.

. For forms and publications call. The New York use tax should be paid for items bought tax-free over the internet bought while traveling or transported into New York from a state with a lower sales tax rate. The Tax Department recently received notice from the New Jersey Motor Vehicle Commission that they updated their fuel tax rates for the second quarter of 2022 with IFTA Inc.

Keller is An IRS-Approved E-File Provider. The second option is to file your HUT tax return by mail. Use the Step by Step tool to get.

Forms IFTA-105 IFTA Final Fuel Use Tax Rate and Rate Code Table 1 722 and IFTA-1051 IFTA Final Use Tax Rate and Rate Code Table 2 722 reflect the updated rates. Including local taxes the New York use tax can be as high as 4875. Tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax.

New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. IFTA Final Use Tax Rate and Rate Code Table 2 - 2nd Quarter 2021. Thats how most New York State carriers file HUT tax returns.

The New York use tax rate is 4 the same as the regular New York sales tax. You can file a. Using our services you will receive the required permit license and application as easy and soon as possible.

The tax rate is based on the weight of the vehicle and the method that you choose to report the tax. New York Highway Use tax is based on total mileage traveled on New York State public highways and this tax is calculated by the weight of the motor vehicle and the method that you choose to report the tax. Learn more about HUT here.

The following security code is necessary to prevent unauthorized use of this web site. If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. Federal law requires proof that the HVUT tax was paid when you register a vehicle that has a combination or loaded gross vehicle weight of 55000 pounds or more.

If you are using a screen reading program select listen to have the number announced. The New York Highway Use Tax is calculated from a few factors but mileage is the most important part. There are two options for filing a New York State highway use tax return.

Its Quick Easy. You can conduct a standard Web File. Ad File Heavy Vehicle Use Tax Form for Vehicles Weighing over 55000 Pounds.

Rate list for each vehicle category based on their weight is different There are three methods by which you can calculate New York Highway Use Tax. IFTA Final Use Tax Rate and Rate Code Table 2 - 4th Quarter 2021. Our agents process all documentation carefully and effectively.

IFTA Final Use Tax Rate and Rate Code Table 2 - 3rd Quarter 2021. How much is use tax in NY. We provide a full-range registration service for your business.

IFTA-1051 1221 Instructions on form. IFTA-1051 921 Instructions on form. HUTIFTA Application Deposit Unit.

NYS Taxation and Finance Department. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax. Alternative Tax Rate Claim for Fuel Use.

The Federal Heavy Vehicle Use Tax HVUT is required and administered by the Internal Revenue Service IRS. The highway use tax HUT is imposed on motor carriers operating motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. 90300201220094 Page 2 of 2 MT-903 122 To compute the tax due on the schedules below see the Tax rate tables for highway use tax on Form MT-903-I Instructions for Form MT-903Be sure to use the proper tables for your reporting method.

The highway use tax is computed by multiplying the number of miles traveled on New York State public highways excluding toll-paid portions of the New York State Thruway by a tax rate. The tax rate varies depending on the weight of the vehicle and the process in which your company reports the weight of your. 4 The City Sales Tax rate is 45.

Read about the HVUT at the web site of the US Internal Revenue Service or. 20 rows IFTA Final Use Tax Rate and Rate Code Table 2 - 2nd Quarter 2022. To calculate the tax you first need to find the total number of miles traveled on New York State Public Highways.

Highway Use Tax Web File You can only access this application through your Online Services account.

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Highway Use Tax Web File Demonstration Youtube

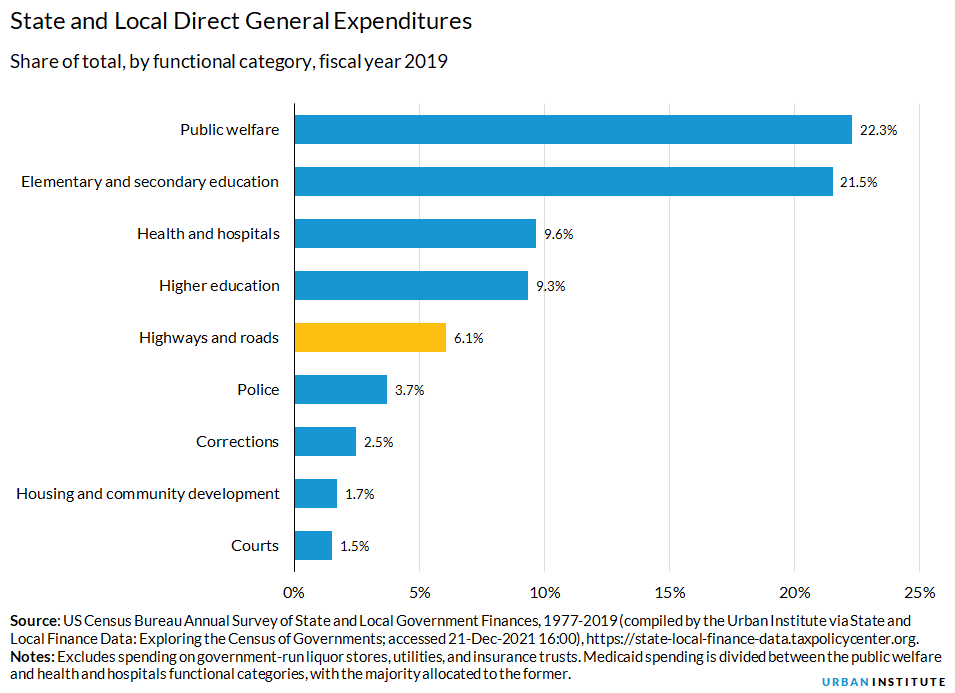

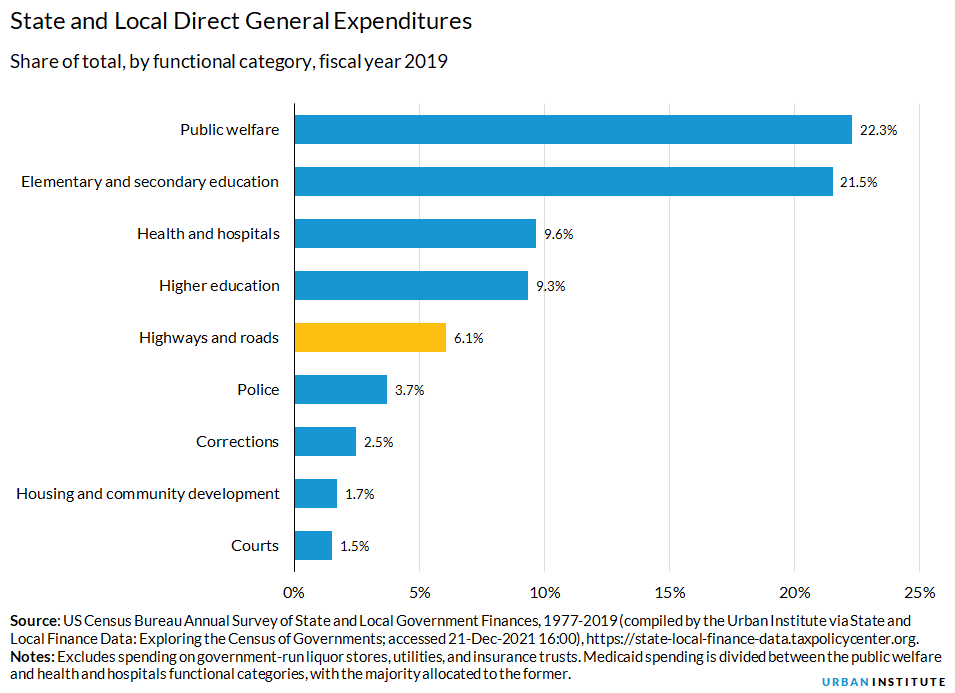

Highway And Road Expenditures Urban Institute

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Top 5 Best Roadside Assistance Services In 2017 Roadside Assistance Roadside Service Roadside

Survey Says D C Is The Worst City For Drivers Which Will Not Surprise Anyone Who Lives Here Road Rage Car Culture Traffic

Highway And Road Expenditures Urban Institute

The 4 Train At Cross Bronx Overpass The Bronx New York New York Subway Bronx

Milton Friedman Inflation Is Taxation Without Legislation Http Bit Ly Ttfn1 Me Too Lyrics Alex Winter Bernie Taupin

Action Asphalt Car Clouds Daylight Fence Highway Landscape Law Light Mountain Outdoors Police Car Road Sky Sun Mobil Polisi Film Romantis Hidup

Judge Overturns Irs On Artist Tax Deductions Irs Internal Revenue Service Tax Deductions

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Florida Form 2290 Heavy Highway Vehicle Use Tax Return

Roads Bridges Ca Governor Looking To Raise Motorist Cost To Pay For Infrastructure Program Construction Gas Tax Road Construction Around The Worlds

Aed5 3 Billion Of Weeklong Real Estate Transactions In Dubai Urdupoint Estates Real Estate Dubai

Pdf Ebook South Western Federal Taxation 2021 Comprehensive 44th Edition By David M Maloney Ja Buy Ebook Online Taxes Ebook

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Requirements To Qualify For Mortgage When You Are Self Employed Good Credit Good Credit Score College Tuition